Whether you’re a small business owner or a self-employed individual, keeping a detailed mileage log is crucial for maximizing your tax deductions. The Internal Revenue Service (IRS) has specific requirements for maintaining a mileage log, and failure to comply could result in missed deductions or even potential audits. In this article, we’ll break down the key aspects of understanding IRS requirements for a mileage log.

Importance of a Mileage Log

A mileage log serves as a record of the miles you’ve driven for business, medical, charitable, or moving purposes. For many taxpayers, business-related mileage is a significant deduction that can lead to substantial savings. It’s not just about claiming mileage expenses; it’s about doing it correctly and efficiently.

IRS Requirements for a Mileage Log

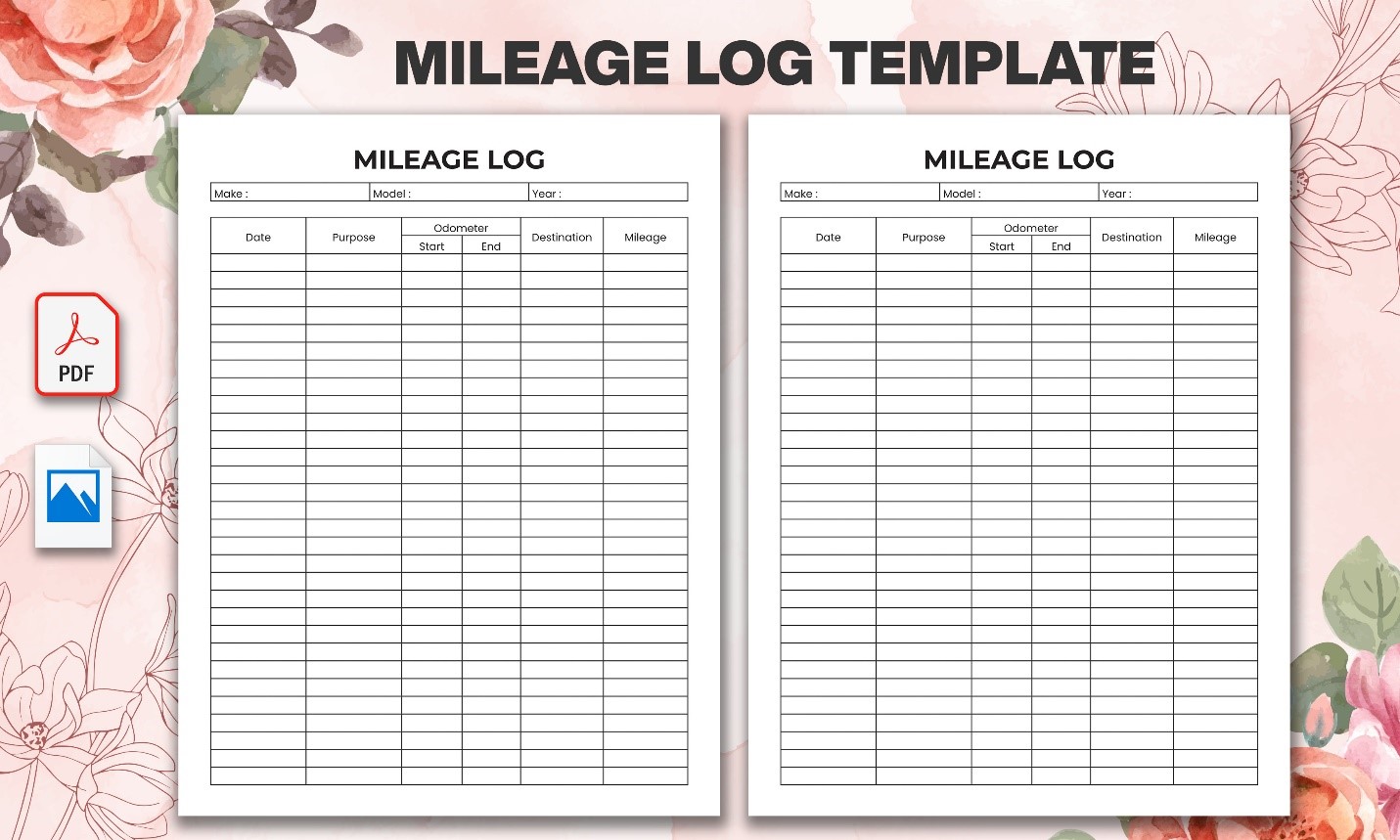

The IRS has clear guidelines on what should be included in a mileage log to be considered valid for tax purposes. Here are the essential elements:

- Date of the Trip: Record the date when the mileage was incurred.

- Starting Point and Destination: Specify the starting location and destination of each trip.

- Purpose of the Trip: Clearly state the business purpose of the trip, whether it’s a client meeting, delivery, or any other work-related activity.

- Mileage Driven: Log the number of miles driven for each trip. This is the core information for calculating deductions.

- Total Mileage for the Year: Summarize the total mileage for the entire tax year. This figure is crucial for claiming deductions accurately.

- Vehicle Information: Include details about the vehicle, such as make, model, and license plate number.

The 7-Minute Solution with MileageWise

Maintaining a comprehensive mileage log might sound time-consuming, but it doesn’t have to be. MileageWise offers a hassle-free solution that takes just 7 minutes a month. This innovative mileage tracker app not only simplifies the process but also ensures compliance with IRS requirements.

Logical Conflicts Monitoring – A Game Changer

One of MileageWise’s standout features is its ability to monitor 70 logical conflicts, ensuring your mileage log is error-free. This advanced functionality significantly reduces the risk of miscalculations or discrepancies that could trigger IRS scrutiny.

Unlocking $7,000 in Deductions

By consistently and accurately tracking your mileage with MileageWise, you could potentially unlock up to $7,000 in deductions annually. This substantial tax benefit can make a significant impact on your bottom line, making the investment in a reliable mileage tracker app well worth it.

AdWise Feature for Forgotten Trips

We all forget to log a trip now and then, but with MileageWise’s AdWise feature, you can catch those overlooked miles. This intelligent tool identifies missed trips and prompts you to add them to your log, ensuring you don’t miss out on valuable deductions.

Conclusion

Understanding IRS requirements for maintaining a mileage log is crucial for anyone looking to optimize their tax deductions. With MileageWise, the process becomes not only compliant but also efficient and user-friendly. By investing just 7 minutes a month, you can confidently navigate the intricacies of IRS guidelines and maximize your deductions, potentially saving thousands of dollars each year.

Visit MileageWise today to revolutionize your mileage tracking and take control of your tax deductions. Start simplifying your financial life while ensuring IRS compliance with this powerful mileage tracker app.