How Instant Exchange Is Changing Online Payment Systems

The digital revolution has completely transformed how people handle money, make transactions, and manage finances. In this evolving landscape, Instant Exchange has emerged as one of the most significant innovations shaping online payment systems. It represents the next step in the financial technology evolution, making online payments faster, safer, and more transparent. Businesses, financial institutions, and consumers are all embracing Instant Exchange as it simplifies currency conversions and accelerates cross-border payments.

The Evolution of Online Payments

The journey of online payments began with simple electronic transfers and credit card transactions. As e-commerce grew, the demand for secure and efficient payment solutions skyrocketed. Payment gateways like PayPal, Stripe, and others made it possible for individuals and businesses to send and receive funds online. However, despite these advancements, there were still delays, high transaction fees, and complications in cross-border exchanges.

Instant Exchange entered this scene as a game-changer. By allowing real-time conversion between different currencies or digital assets, it eliminated the waiting times and inefficiencies that once plagued online transactions. With Instant Exchange, users can now convert currencies instantly, ensuring that payments are processed seamlessly without waiting for traditional banking clearance times.

What Is Instant Exchange?

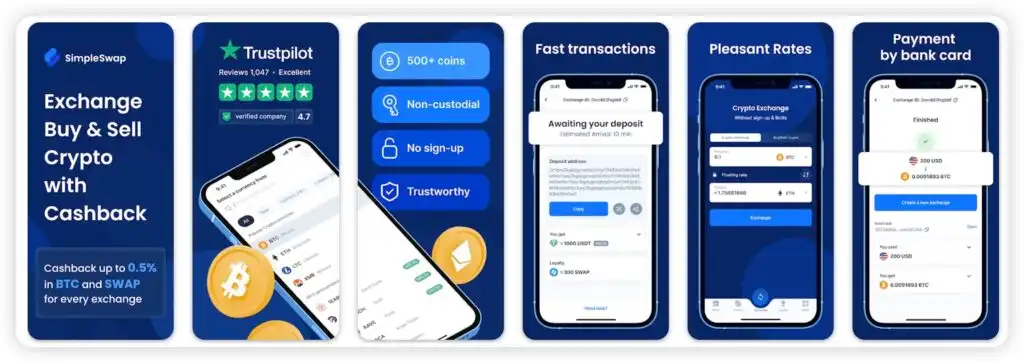

Instant Exchange refers to the immediate conversion of one currency or digital asset into another at the moment of transaction. It can occur between fiat currencies (like USD to EUR), between cryptocurrencies (like Bitcoin to Ethereum), or even between fiat and crypto. The core feature is speed—transactions are completed in seconds, allowing users to transfer value globally without delay.

The process relies on advanced algorithms that find the best available exchange rates in real time. This system ensures that users get the most favorable conversion rates without the need for manual currency trading. Instant Exchange platforms often integrate with wallets, payment gateways, and financial apps, enabling users to perform exchanges seamlessly as part of their normal payment activities.

The Role of Instant Exchange in Modern Online Payments

In the modern economy, where digital payments dominate, the demand for efficiency and speed is at an all-time high. Consumers expect immediate transaction confirmation, and businesses need to process payments globally without friction. Instant Exchange fulfills both needs perfectly.

It reduces the dependency on intermediaries such as banks or centralized currency exchange services, making transactions faster and more cost-effective. This direct exchange mechanism helps both individuals and companies manage funds across different currencies without worrying about conversion delays or hidden fees.

Moreover, Instant Exchange supports the growing global economy. Freelancers, remote workers, and international businesses often deal with multiple currencies. By using Instant Exchange, they can convert payments instantly, minimizing losses from fluctuating exchange rates and avoiding delays associated with traditional banking systems.

Instant Exchange and Cryptocurrency Integration

Cryptocurrencies have significantly influenced the rise of Instant Exchange. Traditional currency conversions require banks and financial institutions to process transactions, but crypto operates on decentralized networks, allowing near-instant transfers. Instant Exchange platforms that support crypto-to-crypto or crypto-to-fiat conversions have become a cornerstone of modern financial ecosystems.

For example, a user can convert Bitcoin into USDT or Ethereum in seconds through an Instant Exchange service. This capability is crucial for traders and investors who need to react quickly to market movements. Similarly, businesses that accept cryptocurrency payments benefit from Instant Exchange by immediately converting digital assets into stable currencies to avoid volatility risks.

Instant Exchange also plays a vital role in expanding cryptocurrency adoption. By bridging the gap between traditional finance and digital assets, it enables seamless payments for goods and services using cryptocurrencies. Users no longer need to worry about long confirmation times or complicated manual exchanges; everything happens automatically and instantly.

The Advantages of Instant Exchange

Speed and Efficiency

The most obvious benefit of Instant Exchange is speed. Transactions that once took hours or even days are now completed within seconds. This is especially valuable for online merchants, freelancers, and international businesses that depend on timely payments.

Reduced Costs

Traditional currency exchanges often involve multiple intermediaries, each charging a service fee. Instant Exchange eliminates many of these middlemen, significantly reducing transaction costs. Lower fees make online transactions more accessible to people around the world.

Transparency and Real-Time Rates

Instant Exchange platforms provide real-time rate information, allowing users to see exactly how much they will receive after conversion. This transparency builds trust and helps users make better financial decisions.

Accessibility and Inclusion

Instant Exchange technology has made global payments accessible to more people. Even those without access to traditional banks can now participate in the global digital economy through crypto-based Instant Exchange platforms. This financial inclusion opens opportunities for millions of users worldwide.

Security and Reliability

Most Instant Exchange systems use advanced encryption and blockchain verification to ensure secure transactions. With fewer intermediaries and automated processes, there are fewer points of failure and reduced chances of fraud.

The Impact on Businesses and Consumers

For businesses, Instant Exchange simplifies international commerce. Companies can accept payments from customers in different currencies and automatically convert them into their preferred one. This not only speeds up cash flow but also helps avoid complications from fluctuating exchange rates.

E-commerce platforms and service providers benefit the most from Instant Exchange. A seller in the United States can receive payments from a buyer in Europe or Asia without worrying about conversion delays or fees. Similarly, freelancers and remote professionals can receive instant payments from clients across the world in their preferred currency.

Consumers also gain convenience. They can make online purchases, pay for digital services, or send money abroad instantly, without having to deal with complex exchange procedures. This seamless experience has made Instant Exchange one of the most sought-after features in modern payment platforms.

The Future of Instant Exchange in Global Finance

As digitalization continues to shape financial systems, Instant Exchange is expected to play a central role in defining the future of money movement. The demand for real-time settlements is rising, and global institutions are recognizing the potential of this technology to revolutionize traditional finance.

Central banks and financial regulators are already exploring how Instant Exchange mechanisms can integrate with central bank digital currencies (CBDCs) and blockchain networks. The goal is to create a unified system where fiat and digital assets coexist and move freely across borders.

Artificial intelligence and machine learning will further enhance Instant Exchange efficiency by predicting rate changes and optimizing transaction timing. In the near future, businesses and consumers may enjoy fully automated, AI-driven Instant Exchange systems that execute conversions at the best possible rates without manual input.

Challenges and Considerations

While Instant Exchange brings many advantages, it also faces challenges. Price volatility in cryptocurrency markets can affect exchange values. Additionally, regulatory frameworks for digital currencies differ across countries, creating legal complexities for global transactions.

Security remains another concern. Although blockchain-based exchanges are generally secure, cyber threats and hacking attempts are always possible. Continuous innovation in cybersecurity measures is essential to protect users and maintain trust.

Despite these challenges, the adoption of Instant Exchange continues to grow rapidly. Financial institutions and fintech startups are constantly developing new solutions to make exchanges faster, safer, and more user-friendly.

Conclusion

Instant Exchange is not just an improvement—it is a transformation of how online payment systems operate. By offering speed, transparency, and security, it empowers businesses and individuals to transact globally without barriers. The ability to instantly convert between currencies or digital assets is revolutionizing global commerce, bridging the gap between traditional finance and the digital economy.